The Financial Times (FT) today released the Financial Times Top 300 Independent Registered Investment Advisers (RIA) of 2015. The ranking of top U.S. RIAs was developed in collaboration with Ignites Research, a subsidiary of the FT that provides business intelligence on the investment management industry.

The average FT 300 firm has been in existence for 23 years and manages $2.6 billion in assets.

They hail from 34 states and Washington, D.C. FT 300 advisers represent many wealth managers; high net worth individuals ($1 million to $10 million to invest) account for 36% of the assets managed and ultra-high net worth clients (more than $10 million) account for another 27% of assets managed.

This was the second annual FT 300 ranking, and it illustrated the maturing of the RIA industry. “The FT 300 research revealed a trend towards larger and more corporate RIA firms, said Loren Fox, Director of Ignites Research and head of the FT 300 ranking. “While in 2014, 89 percent of the FT 300 firms worked in teams, in 2015 94 percent of the FT 300 advisors work in teams. The growth of the team-based approach also means larger staffs, as the average FT 300 firm had 20 staffers this year, up from 14 staffers last year.”

This year, Betterment LLC became the first pure robo-adviser to earn a spot in the FT 300 — marking the arrival of the “robo-adviser.” The use of computerized interfaces and algorithms to create portfolios for investors has already spawned several robo organizations and attracted billions of dollars in assets. Industry observers wonder; however, if robo-advisers will put many RIAs out of business or will expand the reach of traditional RIA firms.

Ignites Research created the methodology and ranked the advisers. Advisory practices reporting $300 or more in assets under management were allowed to apply. The FT then scored candidate firms on six criteria: assets under management (AUM), AUM growth rate, years in existence, advanced industry credentials, online accessibility and compliance records.

“The competition, as always was fierce,” added Fox. “Dozens of high quality advisers just barely missed the list this year, edged out by peers with slightly better profiles. Sometime the difference was a few more years of experience or a slightly more impressive growth rate. Because AUM and AUM growth together comprise a large segment of our internal scoring, there can be a considerable turnover in the list from one year to the next. Only half of the firms that made the FT 300 in 2014 also made the list in 2015.”

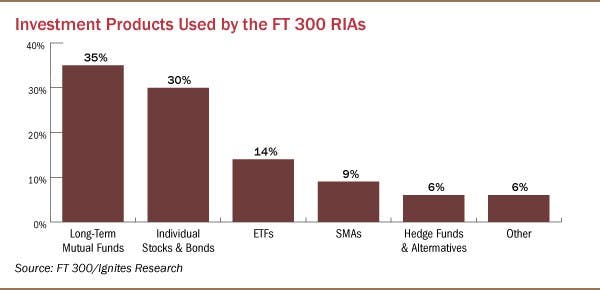

Among the investments used by FT 300 advisers, 35% of the assets they advise are in long-term mutual funds, followed by individual stocks and bonds (30%), ETFs (11%) and SMAs (8%).

Roughly 98% of FT 300 advisers have advanced industry designations, such as the Certified Financial Planner (CFP), Chartered Financial Analysts (CFA) and Chartered Financial Consultants (ChFCs). These credentials are important as advisers need to differentiate themselves from the competition and the growing use of robo-advisers.

The FT 300 is one in a series of rankings that the Financial Times has developed in partnership with Ignites Research providing a snapshot of the very best advisers across the U.S. The series includes: FT 401 (retirement plan advisers who service DC plans), FT 400 (financial advisers from traditional broker-dealer firms), and FT 100 (female advisers from brokerages, private banks and RIAs).

The FT 300 full report is available for viewing at

- Ends -

About the Financial Times

The Financial Times, one of the world’s leading business news organisations, is recognised internationally for its authority, integrity and accuracy. Providing essential news, comment, data and analysis for the global business community, the FT has a combined paid print and digital circulation of 720,000. Mobile is an increasingly important channel for the FT, driving almost half of total traffic. FT education products now serve two thirds of the world’s top 50 business schools.

About Ignites Research

Ignites Research delivers original research and analysis on the retail mutual fund market from experienced analysts. With fresh content delivered straight to inboxes every week, its research covers the distribution and product topics that asset managers must understand to improve their business. Ignites Research is a sister site to the popular online newsletter Ignites, and is a subsidiary of the Financial Times.

For further information please contact

Michael Ferraro

(212) 542-1223

mferraro@money-media.com